Multi-Asset Lending Protocol

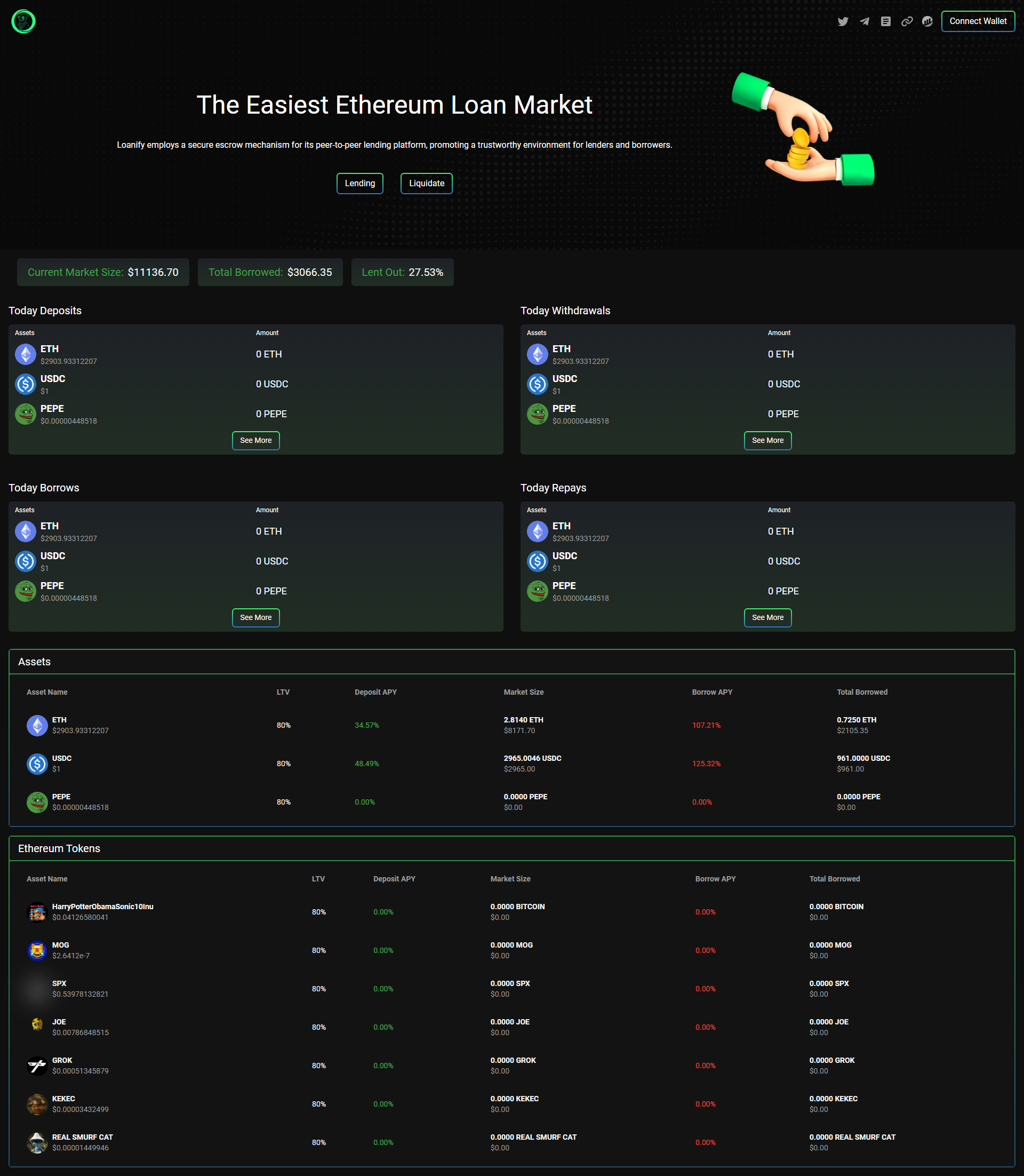

Decentralized lending platform supporting ETH, USDT, and DAI with automated liquidation mechanisms, collateral management, and real-time interest accrual.

Project Overview

We built a sophisticated decentralized lending protocol that enables users to lend and borrow multiple digital assets with transparent interest rates, automated risk management, and instant liquidity access. The platform uses smart contracts to manage collateral ratios, execute liquidations, and distribute yields efficiently.

Key Features

Multi-Asset Support

Lend and borrow ETH, USDT, and DAI with dynamic interest rates based on utilization

Automated Liquidations

Smart contract-based liquidation engine that protects lenders and maintains protocol solvency

Collateral Management

Flexible collateral ratios with real-time health factor monitoring and alerts

Interest Accrual

Continuous compound interest calculation with transparent rate algorithms

Flash Loans

Uncollateralized loans within a single transaction for arbitrage and refinancing

Governance Token

Protocol governance through voting on interest rate models and risk parameters

Transformative Results

Technical Architecture

Smart Contracts

- • Compound Finance-inspired architecture

- • Automated interest rate models

- • Oracle-based price feeds (Chainlink)

- • Comprehensive security audits by CertiK

Infrastructure

- • Next.js frontend with real-time updates

- • The Graph for indexed blockchain data

- • AWS infrastructure with auto-scaling

- • Redis caching for optimal performance

Ready to Build Your Lending Protocol?

Let's create a secure and scalable DeFi lending solution for your ecosystem.

Start Your Project →